Ace Tips About How To Get Rid Of Pmi On Fha

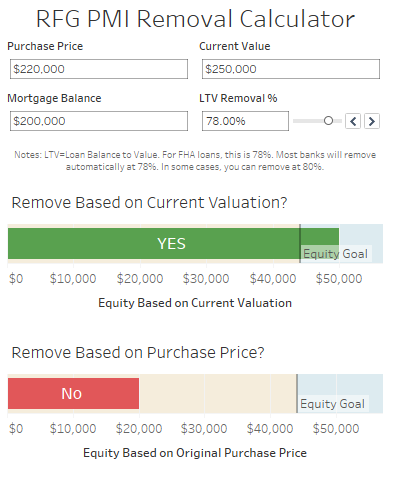

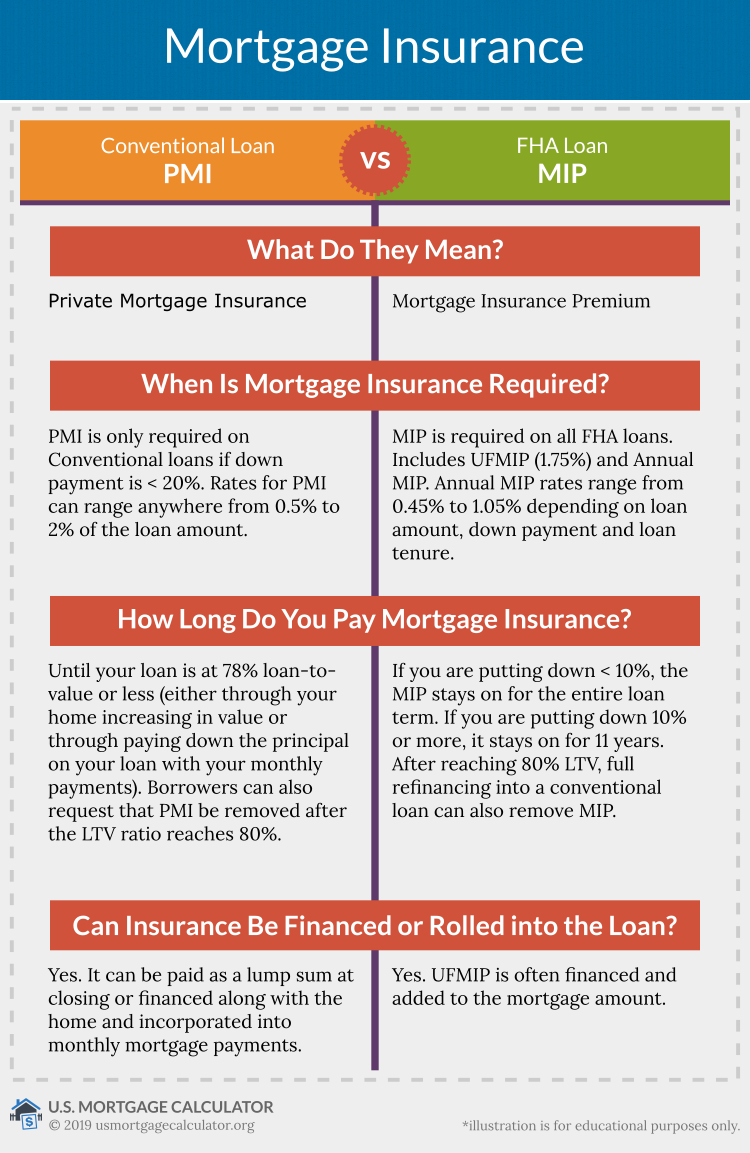

Conventional pmi usually goes to zero when you’ve attained a home equity of 22%.

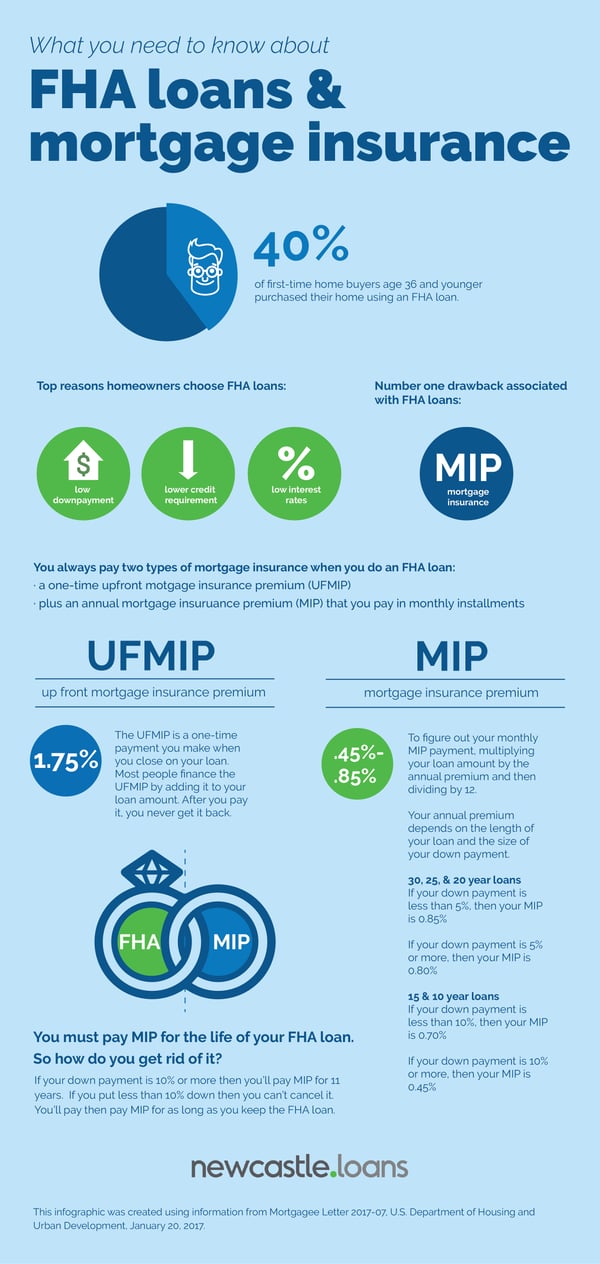

How to get rid of pmi on fha. Apply easily and get pre approved in 24hrs! How to get rid of mip on an fha home loan. If you have an fha loan term of more than 15 years, have been paying it for at least 5 years, and have an ltv ratio of 78% or less, pmi can be removed from the loan.

Browse our collection and pick the best offers. Pmi will actually be removed once you pay 82 percent of the house’s cost. How do i get an fha loan?

If you’re in search of how to get rid of pmi on a fha loan, you’ve come to the right place. How to get rid of fha pmi? Faqs about getting rid of pmi.

Buy a home or refinance the easy way. Check out the latest info. Common method for dropping pmi.

The cash can go toward any purpose, remodel, consolidating debt or other financial goals. Options for getting rid of pmi include the following: Apply & start your home loan today.

Paying a higher down payment. If you take advantage of the fha streamline refinance to secure a lower interest rate you will still pay the mip. How do you get rid of pmi on fha loans?