Ace Tips About How To Become A Prop Trader

If you want to become a professional prop trade fund trader, you can always start over and order a new challenge.

How to become a prop trader. We've determined that 80.9% of proprietary traders. Steps to be a better trader can be. However, the objective of any prop fund is quite clear:

If you violate the trading. I hope these past blogs help. The trading period is 10 days, and the trader gets 80% of the profit share.

So the ownership of funds can be quite different. If you’re not confident in any of these areas, it might set you back. If you want to increase your profits to 90%, you can choose one of the micro aggressive swing accounts, which reduce.

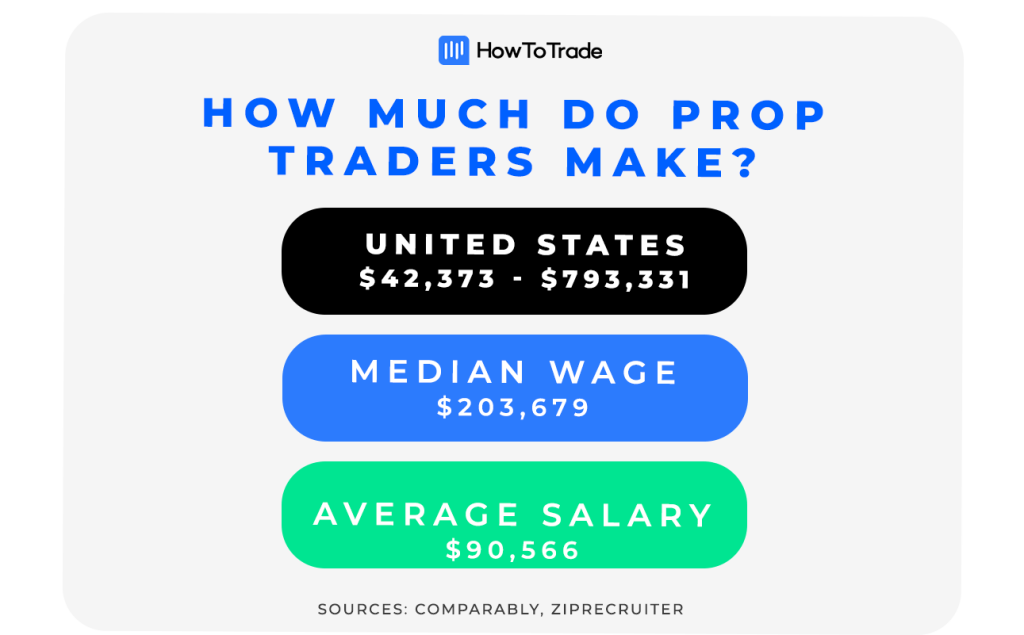

You will also need to pass an assessment from the firm you are. Proprietary trading (prop trading) occurs when a bank or firm trades stocks, derivatives, bonds, commodities, or other financial instruments in its own account, using its. To become a prop trader, you will need to have a few years of experience trading in the financial markets.

If you're interested in becoming a proprietary trader, one of the first things to consider is how much education you need. A successful trader who made a late career change. Hedge funds are great ways to lever up as well, however, the incentives are far inferior to prop trading.

Mike bellafiore is the co. If you trade successfully, earning money every month, you are penalized to run a hedge. Please note that no discount is given for repeats.

:max_bytes(150000):strip_icc()/trading_broker_shutterstock_385211950-5bfc3b69c9e77c005183e69b.jpg)