Perfect Info About How To Reduce Refinancing Closing Costs

However, you can save hundreds of dollars on no closing cost refinance if you follow some guidelines as mentioned below:

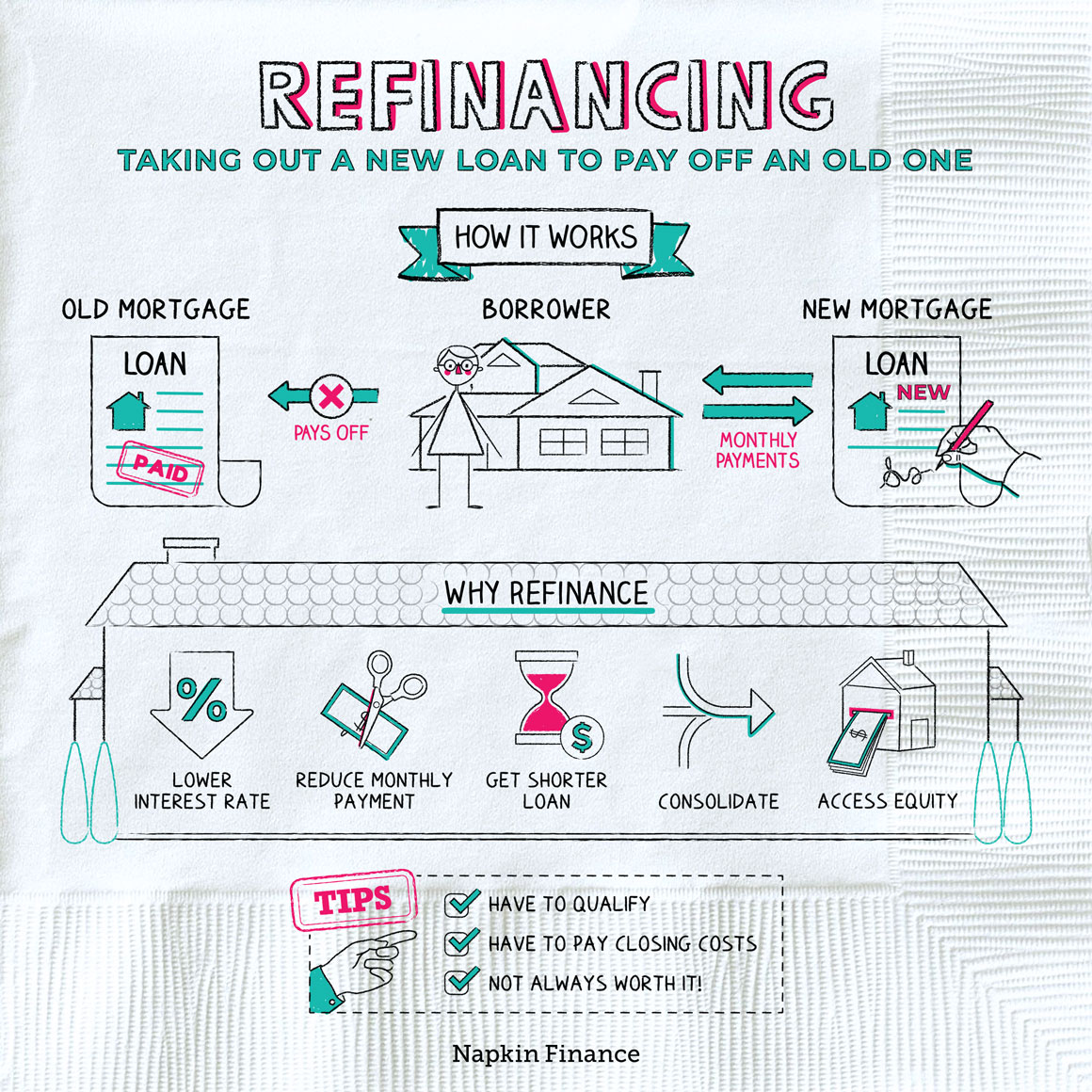

How to reduce refinancing closing costs. Making a large lump sum payment and asking your lender to restructure, or “recast,”. Ad lock your rates for up to 90 days! The refinance lender should give you the closing disclosure form as early on as possible.

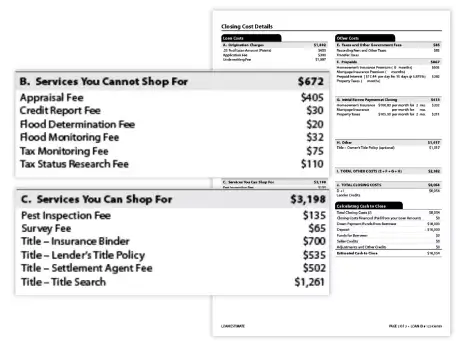

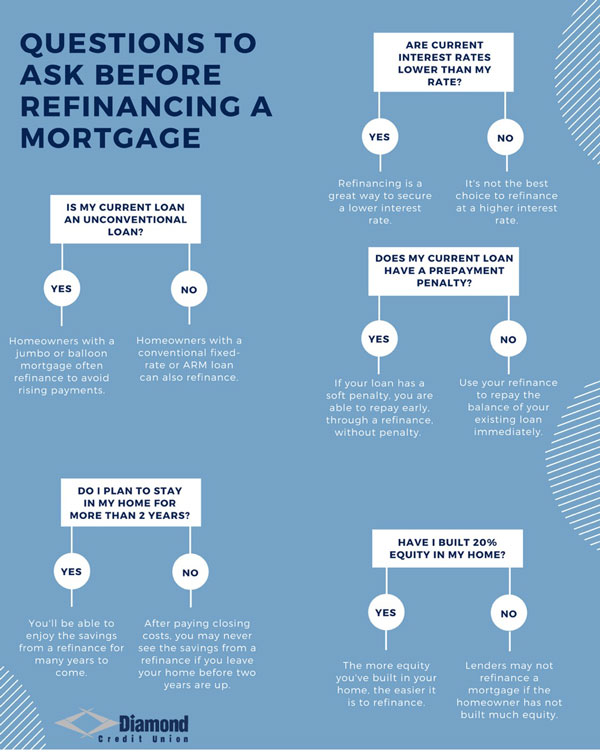

Your closing costs include per diem. Shop around for mortgage lenders mortgage refinance lenders compete for your business just like grocery stores and. This fee is required to start a new loan application process, the cost of which varies by lender.

The trouble is, you often don't know your exact closing costs until it's too late to turn back. Ad if you owe less than $420,680, take advantage of a generous mortgage relief program & refi. If you can’t waive the appraisal altogether, you may be able to save money by opting for an automated appraisal instead of a full appraisal.

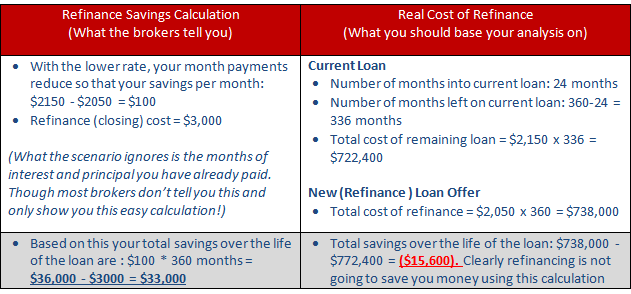

You can choose to reduce your interest rate by 0.25% for each point you buy. 2 days agothe best mortgage refinance companies have a lot to offer homeowners, but finding the right fit will depend on a borrower’s specific circumstances. You can pay extra at closing to reduce your interest rate.

How to reduce your refinance closing costs keep an eye out for ‘junk fees’. It costs $0 to run the numbers & recalculate your new payment.don’t wait, refinance & save On home purchase transactions, the buyer/borrower can ask the seller to pay for the buyer’s closing costs.

If you can negotiate the interest rate down to 2.75%, then you save $220 a month. Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. No closing cost refinance mortgage, lowest.